2024 CLIMATE FINTECH ACCELERATOR OPENS TO STARTUPS AROUND THE WORLD

Join Us to Decarbonize the World

Climate Fintech – Digital financial technology that catalyzes decarbonization.

Climate Fintech is simply the intersection of climate, finance, and digital technology. These digital innovations, applications, and platforms serve as crucial financial intermediaries and mediums between all stakeholders pursuing decarbonization.

How can Fintech be channeled and applied to address climate change? Within this report, we set out to explore how Fintech can help mobilize more capital in the pursuit of reducing greenhouse gas emissions (GHG). The inaugural Climate Fintech Report explores crucial intersections of digital financial technology and climate as a fresh perspective by which to pursue decarbonization – through nurturing an emerging digital ecosystem of climate capital catalysts.

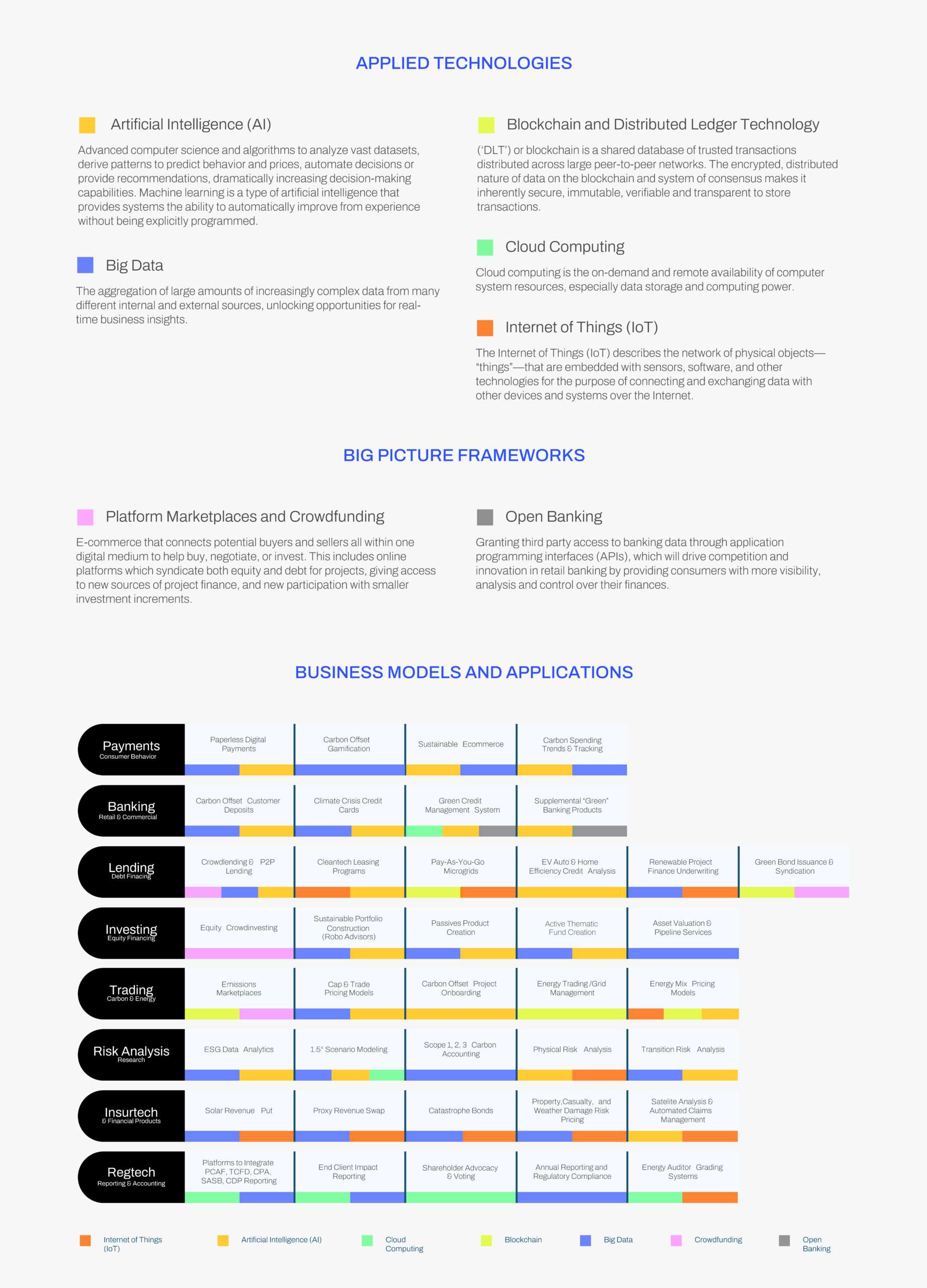

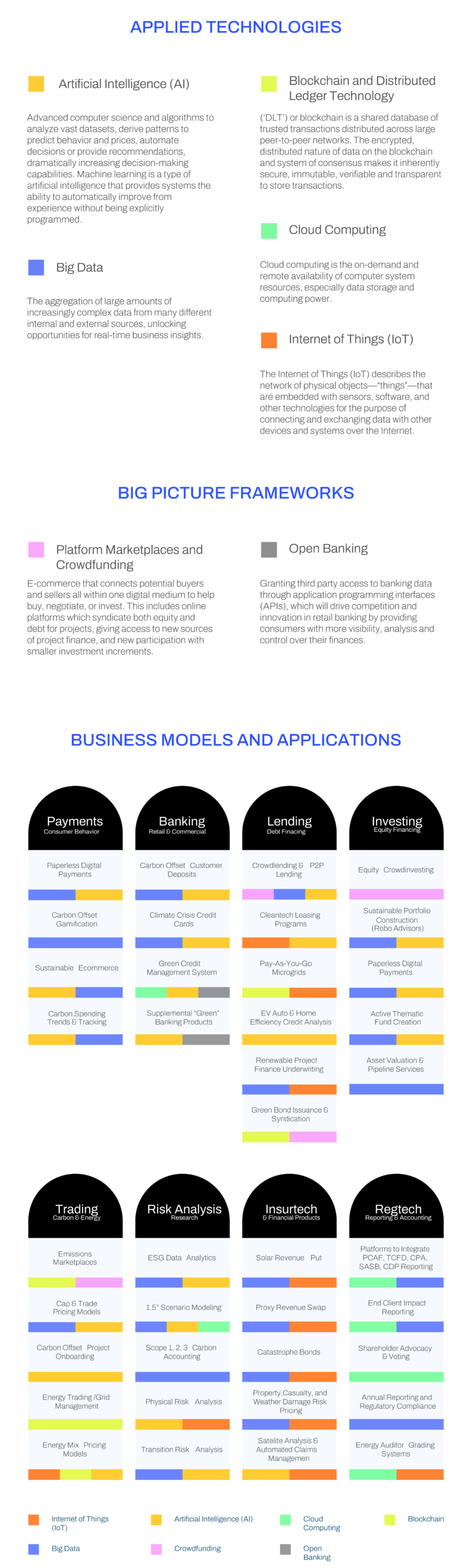

Below are Climate Fintech business models which have been sorted based on their application within the financial system. Additionally, we have color coded these business models per the key on the right side, based on the applied technology or framework which is most commonly used by the business model.

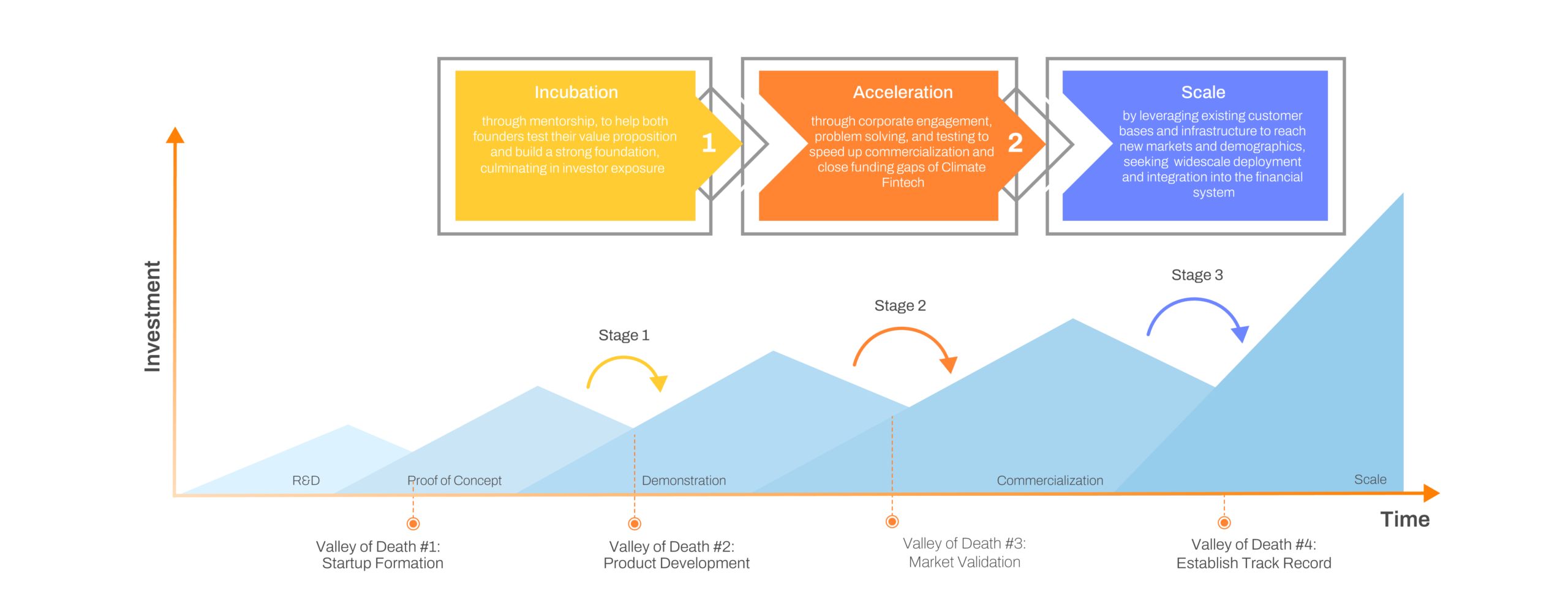

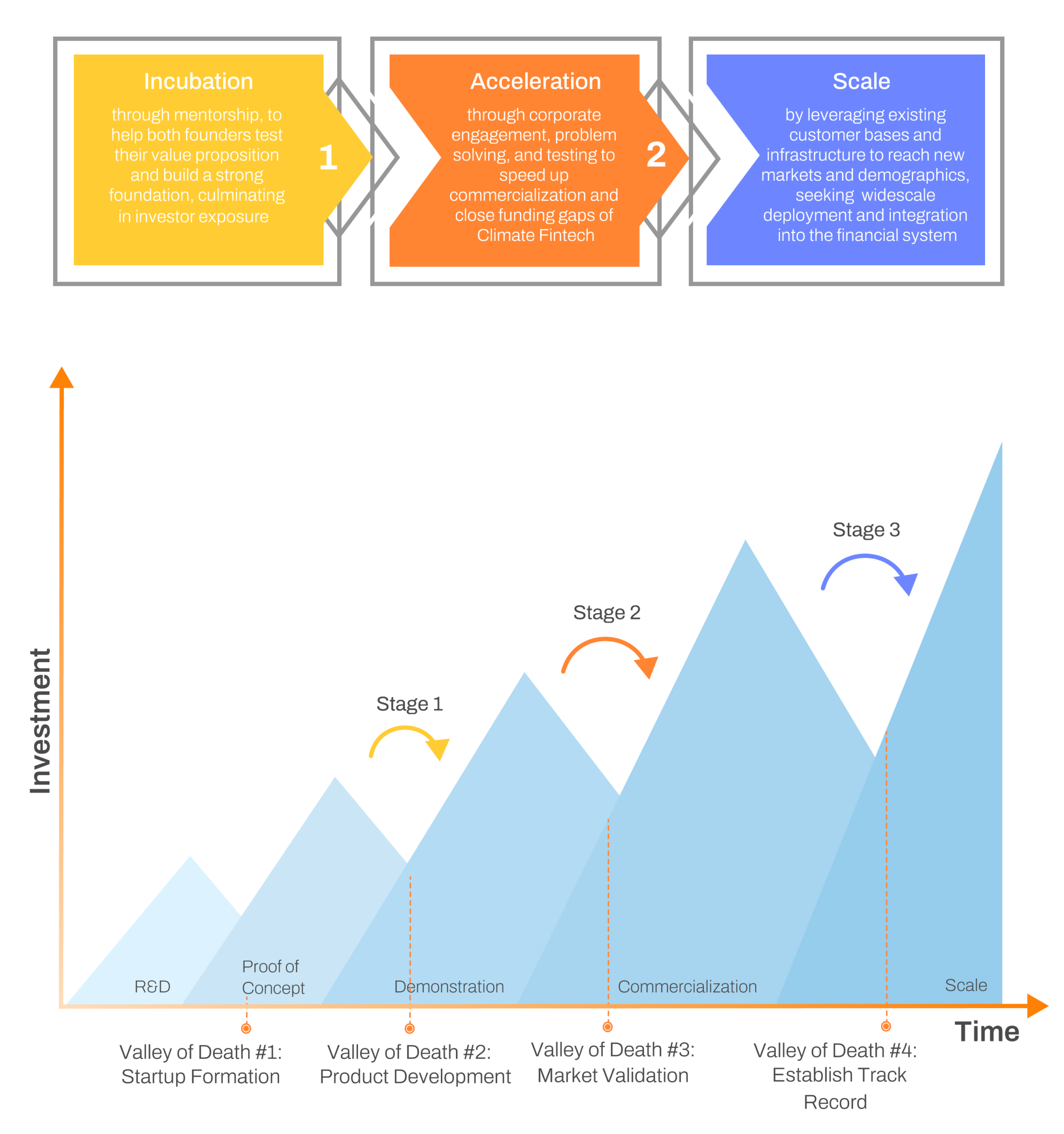

Our Programs enhances the startup value proposition for target customers – whether these are citizens or financial institutions. The focal point is achieving commercialization.

Put simply, solving climate change requires creating a new inertia. Since the industrial revolution, large economies have been driven by carbon-emitting energy, agriculture, and industrial systems. The invisible engine underlying it all has been finance; and at last, finance is facing disruption. This report lays the foundation for why it’s so important to leverage this disruption for the benefit of people and planet.

Climate & Clean Energy Finance Program Officer William and Flora Hewlett Foundation

Christine Lagarde, President of the European Central Bank said that we need forward- looking, dynamic data to address the gap in pricing risk due to climate change and nature loss. We can fix this with a planetary computer that connects satellites and sensors, by sharing information securely using Blockchain technologies, and by leveraging Artificial Intelligence for presentation in a standardized format. When combined, these tools allow for more stakeholders to consider climate risk in their decision-making. Climate Fintech actors will be the first movers to connect the needs with solutions and build a financial ecosystem to save the planet.

Founder | Responsible Risk Solutions

Asset managers are key contributors to the ecosystem of low-carbon investment. In the evolving pursuit of sustainable investing, Climate Fintech offers solutions to help leverage alternative data, ESG analysis, climate-risk modeling, and ultimately influence investment decision-making. This report shows how these cutting-edge technologies give investors tools to help decarbonize their investment activities, while further assisting countries towards sustainable development.

CEO | China Southern Asset Management

New Energy Nexus (NEX) is a global nonprofit supporting diverse climate entrepreneurs to accelerate the transition to 100% clean energy for 100% of the population. New Energy Nexus provides funds, accelerators and networks to drive climate tech innovation and adoption.